Colorado Reverse Mortgage Loans

What Is a Reverse Mortgage?

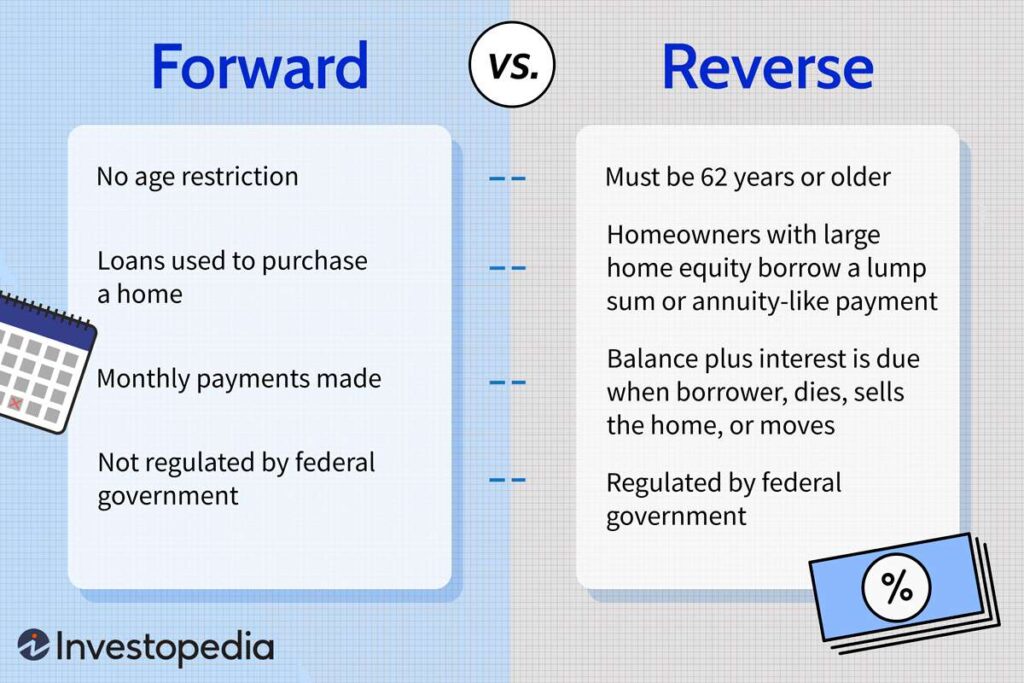

A reverse mortgage is a type of loan available to homeowners 62 and older that allows you to convert part of your home’s equity into cash — without having to sell or move out.

Unlike traditional mortgages, you don’t make monthly payments. Instead, the loan is repaid when you sell the home, move out, or pass away. You retain full ownership and title to your home as long as you meet the basic requirements (like paying property taxes, homeowner’s insurance, and maintaining the property).

Who Qualifies for a Reverse Mortgage?

To qualify for a reverse mortgage (Home Equity Conversion Mortgage — HECM), you must:

Be 62 years of age or older

Own your home outright or have a low remaining mortgage balance

Live in the home as your primary residence

Have the financial ability to pay property taxes, homeowners insurance, and upkeep

Your home must also be:

A single-family home, 2–4 unit property, FHA-approved condo, or manufactured home (meeting FHA guidelines)

How a Reverse Mortgage Can Help

Reverse mortgages aren’t one-size-fits-all. Here’s how they benefit a variety of people:

1. Retirees Needing Extra Income

Get monthly payments or a line of credit to supplement Social Security or pensions — tax-free.

2. Eliminate Monthly Mortgage Payments

Use a reverse mortgage to pay off your existing loan, freeing up cash flow while staying in your home.

3. Fund Long-Term Care or Medical Costs

Pay for in-home care, medical expenses, or home modifications so you can age in place comfortably.

4. Help Family or Grandchildren

Tap into your equity to help loved ones with education, home buying, or other financial support — without impacting your lifestyle.

5. Buy a New Home

Use a Reverse Mortgage for Purchase (H4P) to buy a new primary residence with no monthly payments — ideal for downsizing or relocating.

Is a Reverse Mortgage Right for You?

It’s not for everyone. But it can be a powerful retirement tool for the right situation.

Schedule your free, no-obligation consultation with Regan Archer to:

See how much you could qualify for

Understand costs, fees, and responsibilities

Get a personalized breakdown of loan options

Common Questions Answered

Q: Will I lose my home?

A: No — you remain the homeowner as long as you meet basic obligations like taxes and maintenance.

Q: Will my kids inherit debt?

A: No — reverse mortgages are non-recourse. Your heirs will never owe more than the home’s value.

Q: Is the money taxable?

A: No — reverse mortgage funds are not considered income and are generally tax-free.